An orange lion is standing by the side of a pool. He knows how to swim, but doesn’t know the rules of this pool. He’s nervous, but gets ready to make the dive into the unknown water… Accessibility for banks is a bit like jumping into an unknown swimming pool. It’s a new territory in business. You don’t know the rules And you don’t know how deep the impact will be. And just like a swimming pool, you don’t know the depth of the water without warning signs.

At ING we’re at the edge of the pool. We decided to jump, while looking around to make sure we catch the impact of accessibility in our day-to-day business. Because we know it will impact our day-to-day business. Accessibility is an important topic. Our purpose to empower people in life and business is aimed at all customers. Everyone matters, especially in banking

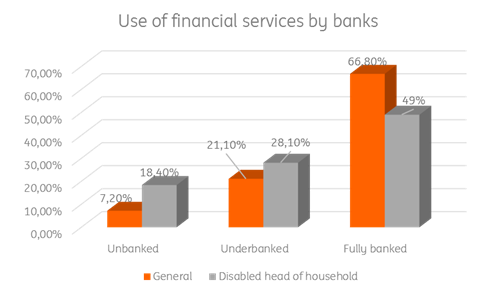

Accessibility to the financial sector is a crucial part of an inclusive society. People simply can’t do without a bank. On the other side, we know that people with disabilities remain the main unbanked/under banked group following research done in the United States[1]. Only 49 percent of households with a caretaker with a disability is fully banked, enjoying complete access to all financial services provided, such as bank accounts, savings accounts, mortgages, among others. 28% is under banked, partially serviced by banks, 18% unbanked, left without access to financial services of banks. We all need to pick up the pace and make sure we offer accessible financial services for all people, without excluding people due to age, digital abilities or disability.

ING is picking up accessibility on a global scale, with a two-way approach: Getting to know our customers with a disability and gaining the knowledge to establish accessibility governance. The backbone to deliver inclusive business for all customers. Such a global approach is a widely discussed challenge in the business disability community [2]. Because we’re all looking at the best approach, in prevention of an accessible headquarter/home country, and inaccessible locations in other countries. No easy challenge to crack, because we encounter many types of regulation. The benefit is that all regulations are focussing on the same goal, with different routes to get there. With a global approach, respecting global and local accessibility/disability regulations, and the opportunity to go beyond a global policy on a local level. We see the opportunity to service all countries, and offer the building blocks to support accessible financial services to the disability community, in all countries we operate. Accessibility will be a challenge. ING is taking that plunge!

Bianca Prins is Global Project Manager Accessibility at ING Bank

[1] FIDIC 2013, https://www.economicinclusion.gov/surveys/2013household/banking-status-…

[2] A network of businesses, and their disability experts, promoting accessibility. Disability experts are people with and without a disability who work in the area of 'accessibility'. (Dutch translation: Disability experts zijn mensen met en zonder handicap werkzaam in het werkveld toegankelijkheid).